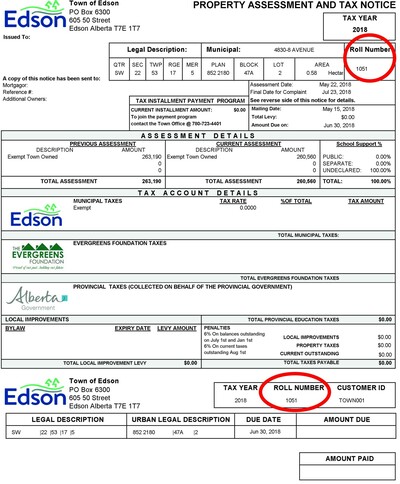

Sign up for automatic withdrawals directly from your bank account. You can register for either or both of the following:

Utilities PAP

-

Full utility account balance withdrawn on the 25th of each month (or next banking day if the 25th falls on a weekend or holiday).

-

Application deadline: 19th of each month.

-

Download the PAP Application Form Pre-Authorized Payment Program (PAP) Form

Taxes PAP

-

Payments withdrawn monthly from January to December.

-

An estimate of your tax levy is divided into 12 equal payments.

-

First payment is withdrawn around January 10th; remaining payments are withdrawn on the 1st of each month (or next banking day)

-

Application deadline: 25th of each month.

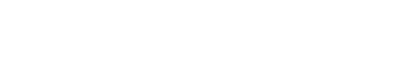

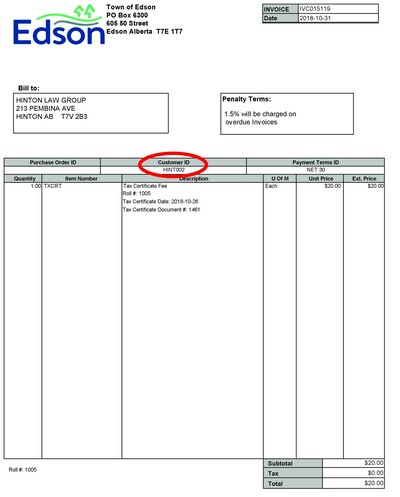

PLEASE NOTE: If you are on our PAP program you will still receive a Tax Notice around the end of May/beginning of June (we mail it out May 15th each year). You DO NOT have to pay this invoice as you are paying it monthly. The tax notice will display the recalculated monthly payment amount near the top of the invoice.

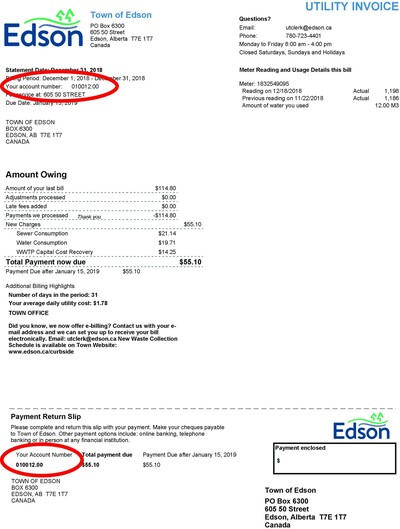

Joining Mid-Year?

You’ll need to make a catch-up payment for missed months.

Example:

Required to Enroll:

Note:

From January to May, payments are based on estimates. After mill rates are approved in May, payments are recalculated. You’ll receive a notice in December each year with your updated estimate for the upcoming year.

To calculate your catch-up payment, please email taxes@edson.caand include your property address or tax roll number.

Deadlines

Late applications may require additional catch-up payments and could result in late penalties.