**NEW** Electronic Tax Notice

Sign up for Electronic Tax notices with the Email Authorization Form or call 780-723-4401 for more information.

How Taxes are Collected

The Town of Edson issues an annual combined tax and assessment notice to all property owners during the month of May each year. This notice contains the levy for municipal tax as well as the school tax levy which is collected on behalf of the Province.

2024 Assessment for 2025 Taxation

2025 Mill Rates

The 2025 final budget was passed in April. Due to accounting changes, year-over-year comparisons are not directly aligned. However, when these accounting adjustments are excluded, the municipal portion of the tax levy reflects an actual increase of $146,794, or approximately 1%, from 2024 to 2025. For full details visit www.edson.ca/budget.

With the taxation set, Council has also given three readings to the 2025 Mill Rate Bylaw. The Town of Edson’s overall taxable assessment has increased by $77.2 million (5.4%). This is used to generate the taxation revenue and is what drives the mill rate calculations. The mill rate refers to the amount of tax payable per $1000 of a property’s assessed value.

Following the release of the 2025 Provincial Budget, the Province has increased the education property tax requisition by 9%. A further increase of 14% is forecasted for 2026. The education taxes are collected on behalf of the Province and are not retained by the Town of Edson.

2025 Residential Mill rates:

Municipal mill rate – 6.9121 mills (2024 mill rate – 6.8437 mills)

Evergreens Foundation mill rate – 0.5603 mills (2024 mill rate – 0.5296 mills)

Education mill rate - 2.7092 mills (2024 mill rate – 2.5385 mills)

2025 Total Combined mill rate – 10.1816 mills (2024 mill rate – 9.9118 mills)

2025 Non-residential Mill rates:

Municipal mill rate – 15.9370 mills (2024 mill rate – 15.7792 mills)

Evergreens Foundation mill rate – 0.5603 mills (2024 mill rate – 0.5296 mills)

Education mill rate - 3.6736 mills (2024 mill rate – 3.7360 mills)

2025 Total Combined mill rate – 20.1709 mills (2024 mill rate – 20.0448 mills)

Understanding Your 2025 Property Taxes: What’s Behind the Increase?

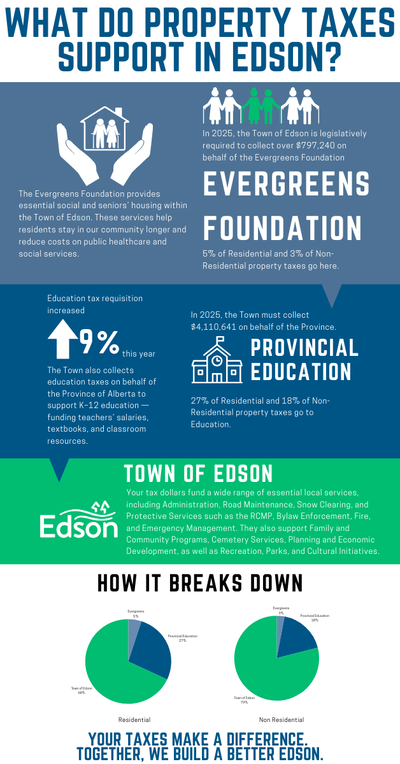

As property tax notices roll out for 2025, many residents are asking the important question: Where do my tax dollars go?

We’ve created a new infographic to help break it all down—and to highlight one key point:

The biggest increase to your property taxes this year comes from the Provincial Education Requisition, not the Town of Edson.

Each year, the Town is legislatively required to collect taxes on behalf of the Government of Alberta to help fund K–12 education. In 2025, that amount is $4.1 million, an increase of 9% from last year. These funds support teacher salaries, classroom resources, and textbooks throughout the province.

Here's how your property tax dollars are divided:

-

Provincial Education: 27% of residential and 18% of non-residential taxes

-

Evergreens Foundation: 5% of residential and 3% of non-residential taxes

-

Town of Edson: The remaining funds go directly to maintaining and improving our local services, including:

-

Road maintenance and snow clearing

-

Emergency services (Fire, RCMP, Bylaw)

-

Parks, recreation, and community programming

-

Cemetery, planning, and development services

-

Your tax dollars help build and maintain a thriving Edson.

Payments and Penalties

-

Taxes due upon issue

-

Penalty on Current Taxes:

-

July 15 - 7%

- September 15 - 9%

-

-

Penalty on Tax Arrears:

-

January 15 - 8%

- March 15 - 4%

-

____

Payment Options: A monthly pre-authorized payment plan by automatic bank withdrawals is available for your convenience. The monthly plan runs from January to December each year. Contact the Finance Department to sign up.

Payments may be made at the Civic Centre, through internet banking, at your financial institution, or through the mail.

If you have appealed your current year property assessment, payment in full is still required to avoid penalty. In the event that your appeal is successful an adjustment will be made and a refund will be issued to you.

Late Payment Penalty: Any outstanding balance on your tax account after each penalty deadline is subject to a 7% penalty.

New Title Holders: Due to ongoing delays with Alberta Land Titles document registration processing times, recent ownership and mailing address changes may not be reflected on municipal property tax notices. The TOE will be mailing the 2025 Combined Assessment and Tax Notices in May. If you have purchased a property in the TOE in the last 4 months and have not received your tax notice, please contact TOE office.

Assessment Practices

Market value assessment has been recognized around the world since the 1970s. It is considered to be the most fair and transparent manner to distribute property taxes.

The market value of residential properties is calculated through a method known as mass appraisal.

Your property assessment notice indicates the Town’s estimate of your property’s market value—the amount it would have sold for in the open market—on July 1 of the previous year. And, it is adjusted for any changes in physical condition recorded by December 31. Provincial legislation establishes these dates and requires that property assessed values be estimated every year.

To ensure assessed values are fair and accurate, they are reviewed at three levels:

- Edson’s internal checks and balances,

- The Alberta government's annual assessment audit process and

- Individual property owners’ review of their notice.

Those with concerns regarding assessment are encouraged to contact the Town’s assessor first. If still unsatisfied, please contact the Town Office for details on the appeal process.

Market Value

Factors that affect residential market value may include

- Location

- greenspaces

- community services

- commercial properties

- multi-family properties

- waterways

- schools

- trains

- transmission lines

- communications towers

- fire hydrants

- Land Use (zoning)

- Size of home/lot

- Other influences (restrictions, environmental concerns, access, servicing, etc)

- Total finished living area

- Quality of structure

- Age of structure

- Modernization level

- Building type (i.e. duplex, etc.)

- Unit type in condominiums (i.e. townhouse, apartment, basement unit, end unit, penthouse unit, etc.)

- Garage type and size

Assessment Appeals

If you are not satisfied with the assessment after speaking with the Town’s assessor (info@compassac.ca), you may file a written complaint with the Assessment Review Board. An assessment complaint must be filed using the Government of Alberta’s “Assessment Review Board Complaint Form,” available at the Town Office (605 50 St) or online at http://www.municipalaffairs.alberta.ca/documents/as/LGS1402.pdf.

A complaint must be submitted with the appropriate Assessment Appeal Fee as follows:

- Residential - $25 per Tax Roll

- Non-Residential - $150 per Tax Roll

A separate appeal must be made for each parcel of land (ie Tax Account). The fee will be refunded if the Board rules in favour of the complainant.

Please submit assessment appeals to:

Assessment Review Board

c/o Assessment Review Board Clerk

Town of Edson

Box 6300

Edson, AB T7E 1T7

Please Note

Your complaint must be made on or before the end of regular business hours on the final date of complaint as shown on the front of your Property Tax and Assessment Notice.

A complaint against your assessed property value does not exempt you from paying taxes on time or, from late payment penalties. If a complaint is successful, the adjustment will be applied to the tax roll. Refund requests must be made in writing.

Designated Industrial Property Assessment

An Assessment Review Board has no jurisdiction to deal with complaints about assessments for designated industrial property. The Municipal Government Board has jurisdiction to hear complaints about assessments for designated industrial property. Complaints on designated industrial property assessments must be submitted to the Municipal Government Board by the deadline shown on the designated industrial assessment notices.

Questions?

For specific assessment information please contact the Town of Edson Assessor:

Compass Assessment Consultants Inc.

Aaron Steblyk

Phone: 1-800-251-9711

Fax: (780) 466-5406

Assessor email

For all inquiries regarding your property tax and school support contact:

Tax Clerk Phone: (780) 723-4401

Fax: (780) 723-8617

Tax Clerk email